Activity Based Costing in Healthcare Industry – Cost per Major Disease Category/ Detail Line of Service

In the last article we saw how to calculate the cost per patient. Here we are looking at how to calculate the cost of a major disease category – a more detailed service line. Two patients undergoing heart surgery end up with differing costs, based on the staffing for the case, the duration of the case, and the supplies actually used. Now the cost accounting information can be used to examine variances in costs and hopefully to reduce costs.

Activity-Based Management

A value-based chain of activities ensures efficient and high quality delivery of care. This is the focus of activity-based management. By elimination and improvement of processes, the following outcomes are possible:

- cost reduction in the activity pools

- decrease in the staff or realignment of the staff

- increase in the number of patients

Fragmentation ratio would help in looking into overcapacity with respect to staff/activity.

Guidelines for ABC implementation

- Obtain the consent, support, and cooperation of hospital personnel to provide the implementation team with inputs on data and policies such as volume of activities, cost pools, cost drivers, expenses etc., .

- The project should have sponsor and a Project Manager. The team should consist of accounting staff, clinicians, office Managers, Stakeholders and nurses.

- Chart the critical path of the service; create process maps and flowcharts of the Department. Avoid kitchen sinks in the process flows – where you have an input and no output.

- Complete the value chain analysis; eliminate redundant processes in service delivery. Consider process re-engineering if the types of activities are not aligned with the final outcome.

- Scrutinize the general ledger accounts to classify the expenses into activities that align with the services provided.

- Build Hierarchies for dimensions for reporting and processing. Make them as close to General Ledger as possible.

- Analyze billing codes. Any code that is not studied should be assigned a standard cost.

- Collate activities to form homogenous pools. Practice Managers /caregivers play important role here.

- Choose activity measures to represent each pool.

- Establish rate policies such as: when to use actual/budgeted rates vs. frozen rates.

- Arriving at the cost of procedure will require integrating data from multiple systems – Billing, OR, Pharmacy, Supplies, Accounting, and lot of manually collected data from activities.

Activities, Expenses, Drivers, Cost Objects, Activity Pools

Activity data is gathered by time studies or having the physician/patient/staff fill out a questionnaire independently. Sometimes the practice manager gives the numbers by observation or interviewing the staff. The activities (lowest level in ABC) in a Cardiology Department may include:

- Reception and admission of patients

- Consultation with physician

- Administration of tests

- Dispensation of medication

- Provision of therapy

- Provision of meal and in-patient facilities

- Nurse visits and monitoring of patients

- Dictation

- Reading test results

- Room setup

- Patient Prep

- Patient education

Cost drivers include:

- # of patients calling or checking in to the hospital for cardiology care

- # of diagnostic tests required. Here you can have pre and post-surgery tests

- # of medication orders called in

- # of procedures or surgeries performed

- # of Nurses

- # of Surgical Scrub Tech

- # of minutes spent by Nurse

- # of minutes spent by Scrub Tech

Some of the expenses are:

- salaries of physicians and surgeons

- include benefits, CME cost, Malpractice costs, License costs

- Weights may be used to allocate Malpractice costs – higher weightage assigned to complex surgeries and lower to simple procedures

- salaries of Nurses and Admin Staff

- Rent of the premise

- cost of utilities

- Cost of the medical equipment used in pre and post-surgery

- Supplies such as sponge

Formation of Activities into Pools:

Some of the obvious costs that one can identify are the direct costs. Examples of these costs are the cost per hour of a surgeon’s time and cost of diagnostic tests.

However, the establishment of the cost of the ancillary activities that are also part of the patient care is of greater significance. In the case of traditional costing systems, a general overhead rate is used to determine such costs which may or may not reflect the true price of the costs that are not directly traceable to a procedure at the hospital. In activity-based costing, this general overhead rate is discarded.

The activities of the Department are classified into groups or pools called cost objects according to their type or purpose. For example, all the activities that are performed in the lobby such as taking telephone calls, handling patient inquiries, or checking for health-care insurance could be grouped into one activity pool — “Hospital Admission”. Similarly, all activities are pooled under different cost objects. Then the cost driver is ascertained for each pool.

Allocation of Direct and Indirect Costs

Direct costs are the costs that can be easily assigned to the activities of one particular activity center or activity pool.

Indirect costs ensure that the main departments/centers work smoothly. Examples of these costs are the costs of maintaining the computer systems / cafeteria services / laundry expenses. These costs are determined according to measures such as the number of PC’s or the number of resources. For instance, the costs of the pharmacy would be based on the number of medication orders that are received.

The costs of such departments or activity centers are assigned to the main departments.

The following example illustrates the allocation of indirect costs:

Let’s take ‘Bypass Surgery for Venous Disease’ a major disease category as cost object and try to find out how much it costs the Hospital.

All the activities that are performed under this procedure are pooled into groups. The overheads are assigned to these pools based on activity measures. Each activity has a different measure. The distribution of resource consumption of the shared costs by the main activity centers is represented in percentages.

For each bypass surgery, a set of activities is performed at a rate or volume per activity. When the overheads or the cost of shared services are assigned to the main activity pools, the cost of the set of activities that constitute one bypass surgery is determined.

This method is vastly different from conventional costing systems that use a generic rate for the allocation of overheads such as hours or patient days.

The Three Allocation Methods for Shared Costs:

Shared costs are tricky in Activity Based costing. They occur since multiple departments use a ancillary department(s), and the allocation needs to consider that ancillaries’ utilization percentage. IT ,HR, Front office fall under shared costs since multiple departments such as cardiology, Nephrology and other departments use them for strategic and operational activities.

Here we are discussing three different ways to allocate shared costs:

1. The Direct Method

The costs of the services are assigned only to the main pools.

2. The Step-Down Method

In this approach, the service department which renders the most service is allocated first.

3. The Reciprocal Method

The services rendered within the shared service departments are recognized and distributed within themselves, apart from distributing to the main activity centers.

As you can see below, IT and HR costs are distributed across Imaging /Diagnostic centers, OR and Pharmacy. In real world, you have the software do these complex math for you. However, make sure you have proper documentation built on you allocations and then let the end users know as to how they work. Sometimes devil is in details.

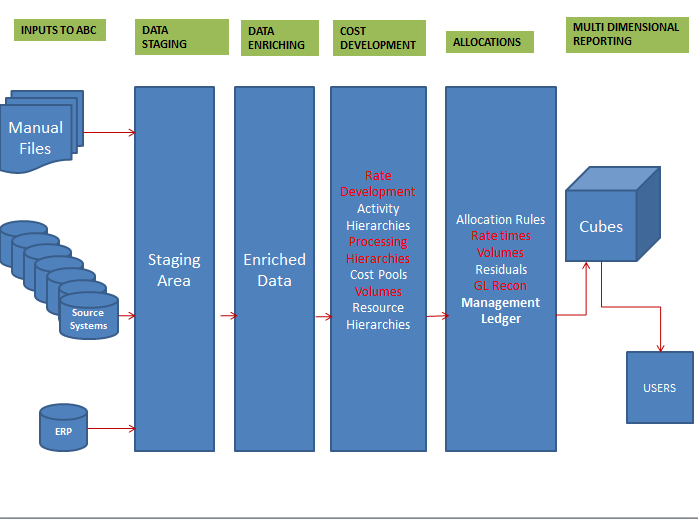

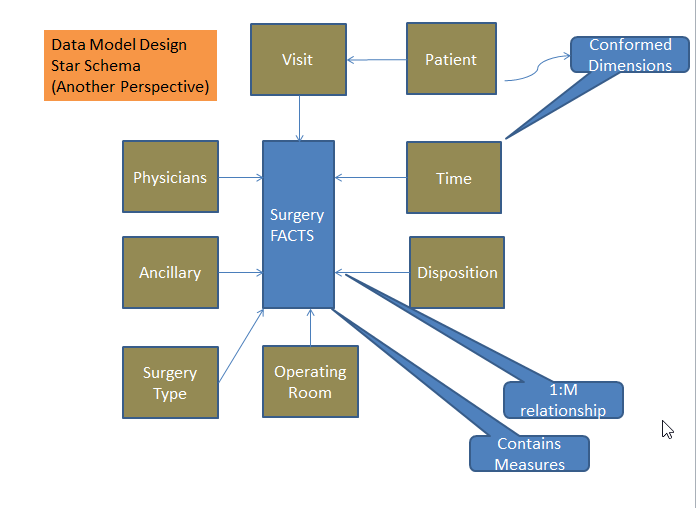

The following technical design gives an overview of how some of the complexity of calculations are taken over by software and how we need to create a data model that is reusable. Data Models are logical representations of how the data will be stored. Management Ledger is the heart of your system – it will have allocated costs along with dimensions. Dimensions help you slice and dice your data in your cubes. We will cover elaborate details later but at this moment understand that Information Technology plays big role in your strategy.

Birds eyeview of Technical Implementation of Activity Based Costing:

Coming back to distribution of shared costs, IT does a very good job in calculating its costs. Here you need to know which projects were undertaken by Cardiology Department that would need IT resources; you may want to take those as direct costs since they are clearly traceable, assuming the resources were working 100% of time on your project.

Capital of employed capital Assets: In this example we took ambulance on lease. However, if the hospital has purchased it on cash, we need to address this scenario in a bit different way. Assign the asset capital basis from the Balance Sheet at a certain percentage to a resource; At the same time take the indirect costs (depreciation) associated with this asset and assign it to the resource. The same concept is applied for speciality equipment such as ECG monitor – the depreciation is assigned to the respective billing codes. The ones such as high end printer will be allocated across the remaining billing codes based on the cost policy.

Here are the details as to how you would distribute shared costs :

In real world the report would like something like this:

Conclusion:

In this article you have seen how we can arrive at cost for detail line of service ; remember line of service is at higher level.